- InvestIQ

- Posts

- Week In Finance: Week 3 Recap (12/24)

Week In Finance: Week 3 Recap (12/24)

Possible Toyota-Honda Merger, Amazon Strikes, Stock Market Updates, and More: Keep on reading to find out.

In 2024, the global mergers and acquisitions (M&A) market experienced a significant rebound, with total deal values reaching $3.45 trillion—a 15% increase from the previous year. This surge was driven by expectations of more lenient antitrust enforcement, lower corporate taxes, and reduced regulation under the U.S. administration

In this week’s edition:

A Potential Power Play: Toyota and Honda's Merger Talks and Acquisition Speculations

Dow Jones ETF Takes a Hit: Analyzing the Losses and Market Reactions

Corporate America's Pledge: Donations for Trump's Inauguration and Its Financial Impact

Greece's Bold Move: Scrapping Bank Fees for Retail Customers and the Economic Implications

A MERGER BETWEEN JAPANESE GIANTS

A Merger in the talks that could shape the Japanese Automotive Industry

Toyota and Honda are currently in discussion for a possible merger. Toyota and Honda are one of the US’s and Japan’s biggest auto giants. It could shake up the entire auto industry and bring significant changes. Additionally if this succeeds, talks for a merger with Mitsubishi Motors may forcome.

If a company were to merge their production facilities and aswell as there R&D teams, from a financial prespective it would allow them to heavily cut costs by combining production facilities. This could then lead to what is called an “Economics of Scale” where the larger company can produce vehicles more efficiently, lowering costs and improving profit margins. It would also help companies’ bargaining power with suppliers which may help reduce costs of raw materials

For investors’ the merger is a huge deal. If the merger is seen as a way to strengthen both companies and improve their market position then stock prices could rise. However if there are delays or challenges with integration or if the deal doesn’t deliver the expected benefits there could be a drop in shareholder value.

Although, there are potential benefits there are also many risks. Merging two large companies with possibly heavily distinct corporate cultures can create integration challenges. Additionally regulatory bodies in various countries may closely scrutinize the deal to ensure that it doesn’t reduce competition or create a monopoly. This Toyota-Honda merger if successful would reshape the global automobile industry even outside of Japan and allow the two companies to better compete in emerging markets like electric vehicles and autonomous driving technology. The deal will make financial and operational decisions about how well companies will navigate the financial and operational challenges ahead.

TLDR:

Honda and Toyota are in talks about a potential merger, which could lead to cost savings, improved production efficiency, and stronger competition against companies like Tesla. The merger could boost their market position, especially in electric and autonomous vehicles. However, challenges like cultural differences and regulatory scrutiny may pose risks. If successful, this deal could reshape the auto industry and lead to significant financial gains for both companies.

A Struggle for the Dow Jones

Stocks are struggling to regain losses.

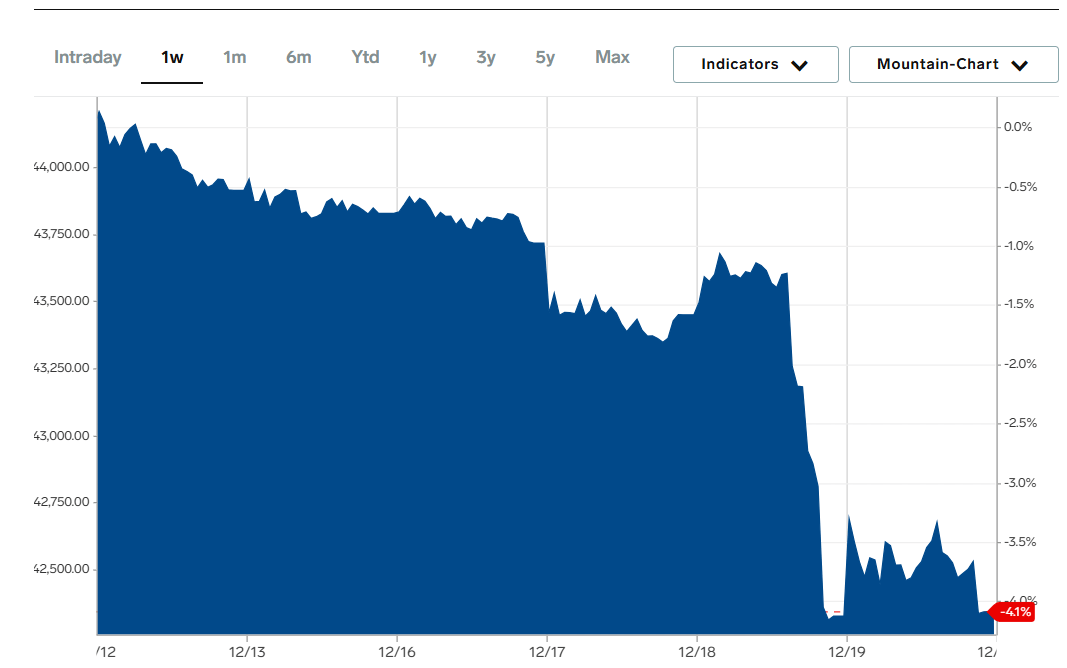

The Dow Jones Industrial Average (DJIA) has recently experienced significant volatility with a notable 10-day losing streak marking its longest decline since 1974. Furthermore, This downturn has been driven by a combination of factors all contributing to heightened market uncertainty.

One of the key factors impacting the DJIA is the Federal Reserve's recent monetary policy decisions. On December 18 2024 the Federal Reserve cut interest rates by 25 basis points (indicates percent change in financial instruments) to a range of 4.25%-4.5%. However, the Fed (Federal Reserve) expressed a more cautious approach despite this rate cut moving forwards and indicated a slower pace of future rate cuts. This shift in policy while aimed at supporting economic growth has raised concerns among investors about the potential for a prolonged period of uncertainty. The stance of the Fed has contributed to a downturn in the stock market as investors digest the implications of faster rate cut.

The Federal Reserve's policies have weighed negatively on the stock market. UnitedHealth's stock, for instance, dropped 18.2% Thursday reflecting investor concerns over potential policy changes in the drug industry and the tragic death of its insurance unit's CEO. Nvidia shares also fell primarily due to increased competition in the AI chip market and a warning from Microsoft's CEO over the future growth of the sector. This corporate challenges have heightened investor anxiety causing further declines in DJIA.

As of December 19, 2024 DJIA closed at 42,342.24, showing a slight recovery from previous losses. The 52-week range for the index falls from 37,122.95 to 45,073.63, illustrating the significant fluctuations that the market has experienced in the past. The DJIA's performance has been heavily influenced by the interplay between the Fed's monetary policies corporate earnings results and overall market sentiment.

TLDR:

The Dow Jones Industrial Average has faced significant volatility, including a 10-day losing streak, driven by a mix of factors. The Federal Reserve's recent rate cut and slower future cuts have raised concerns among investors, while disappointing corporate earnings from companies like UnitedHealth and Nvidia have added to market uncertainty. As of December 20, 2024, the DJIA closed at 42,342.24, showing slight recovery. Investors will need to monitor the Fed's policies, corporate earnings, and broader market sentiment to gauge the future direction of the index.

Corporate America & Trump

Corporate America & Donations To President Trump

Many companies, ranging from finance to technology, are “pledging” donations to President Donald J. Trump’s Inagural Fund. Trump is set to take office in January, and company executives are hoping to build good relations with the president. These relations could bring notable benefits for the companies. Some of the most notable companies who have donated include.

ROBINHOOD MARKETS

AMAZON.COM

META

OPENAI

UBER

TESLA

BANK OF AMERICA

GOLDMAN SACHS

SPACEX

GREECE’S BOLD MOVE

Greece Finance Minister, Kostis Hatzidakis, giving a speech about a “Tourism Tax”

Greece wants to cut its bank fees for retail customers: Economic relief for households 💶

In a move aimed at easing the financial burden on households Greek government has announced plans to reduce bank fees for retail transactions from 2025 onwards. Greek Finance Minister Kostis Hatzidakis said the government is working on measures to reduce the costs associated with daily banking activities. This Initiative comes mainly as part of the broader efforts to help families deal with the high cost of living in the country.

Following its recovery from a severe financial crisis where Greek lenders underwent several rounds of recapitalization and nationalization the banking sector has seen significant improvements. The four major banks in Greece have reduced their non-performing loan ratio to a lower of 6% from 45% in 2017 and will report profits of 3.8 billion in 2024. The positive performance has enabled them to continue to distribute dividends for the first time in 16 years.

WhilST the banks annual fees are 1.8 billion euros, only 10% of this comes from the retail transactions. Analysts have estimated that a 50% reduction in charges would cost banks around 80 to a 100 million euros annually. Despite this, the greek government's plan is seen as a step toward alleviating the financial strain on Greek households, especially as salaries in Greece still fall behind severly compared to the European average and whilst the cost of living continues to rise.

The new fees’ reduction could have a significant impact on Greek consumers as it offers important relief in a period of economic recovery and also benefits the banking sector's ongoing stability and profitability Additional details of the plan will be announced as part of the 2025 state budget.

TLDR:

The country of Greece plans to reduce bank fees for retail transactions starting in FY 2025 to help households manage the high cost of living. The country's banking sector has significantly improved since the financial crisis, with non-performing loan ratios falling from 45% in 2017 to below 6% in 2024. Greek banks are also reporting profits of 3.8 billion euros for 2024 and will distribute dividends for the first time in 16 years.

CONCLUSION

This week in finance saw some important events that may have long-term impacts across a wide range of industries.The Toyota-Honda merger is very exciting, with the two car-makers looking for ways to increase there strenght in the competitive auto market. While the deal could mean cost savings and better production efficiencies, regulatory bodys may post a challange. The Dow Jones Industrial Average has been showing Volitality, on accounts of concern from the “feds” being cautious about cutting intrests rates and the bad earnings reports coming out from many major companies.

Greece wants to cut the cost of banking to ease the pressure for households in the era of rising living costs. The country's banking sector is reporting impressive profits and will soon distribute dividends for the first time in at least a decade. These efforts reflect a wider economic recovery and are a part of efforts to support consumers.

THANK YOU

Thank you for taking the time to read this week’s finance news. Please keep it up. We really appreciate your interest to stay informed about the latest developments in the financial world.

From the potential merger between Toyota and Honda to the Greek effort to reduce bank fees for its citizens there are no shortage of innovations shaping global markets. We hope the insights provided help you stay ahead of the curve.

Your continued engagement is invaluable and we look forward to keeping you informed on the key financial news and trends. Stay tuned for more and thank you again for being part of our journey!

Reply